Wedding Insurance Can Save the Day

In 2016, the average cost of a wedding is about $32,000, according to a survey in The Knot. If you get married in an expensive city like New York or Chicago, your average could be closer to $80,000. That’s a lot of cash to put into one weekend. And while you hope and assume that your celebration will come off perfectly, what if something goes wrong?

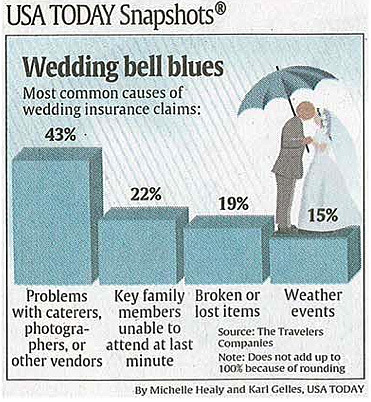

What if your venue burns down or just goes out of business? What if an essential member of the wedding party gets sick or has an accident right before the big day? What if a hurricane or blizzard shuts down travel so no one can get to your wedding destination? Or what if the caterer or photographer just fails to show up?

Wedding insurance can protect you from losses due to all these emergencies, and more. And insurance policies for an average wedding are relatively low cost, usually under $500. This is a tiny investment to protect the tens of thousands you’re likely spending on the wedding.

Here are some of the things you should consider having covered:

- Cost of the venue, in case of a default or disaster that prevents you from having the wedding there.

- Cancellation or postponement of the wedding due to an accident or illness in the wedding party or close family or an unexpected military deployment, or due to catastrophic weather of some kind.

- Loss or damage to your wedding finery, including accidents and theft.

- Loss, damage or theft of wedding gifts that are already in your possession.

- Failure of an important vendor to deliver as promised: the photographer accidentally deleted all your pictures, the groomsmen’s custom ordered tuxedos weren’t delivered, the baker’s delivery van got into an accident with your cake and your whole dessert buffet inside.

- Accidental damage to people or property by overly rowdy wedding guests, and even liability for accidents and injuries caused by inebriated guests on their way home from your wedding.

- Expensive jewelry such as watches, heirlooms, or pieces with precious stones; and even precious stones attached to garments. You will probably need a special rider to cover these.

Before you buy your insurance, though, check for double coverage. Some of your vendors are likely to have insurance of their own that covers various types of losses, including your reception site, your caterer, your limousine service and others. Ask all your vendors what coverage they have, and what losses their insurance won’t cover. Then customize your own policy accordingly.

And remember, there are some problems your wedding insurance won’t cover:

- Bad weather short of a disaster. If you counted on sunshine but got rain, you’ll have to accept it. Wedding insurance only covers losses from catastrophic weather like floods, tornadoes, blizzards, or ice storms that either prevent safe travel to the wedding or prevent the ceremony from taking place.

- Complaints about the quality of wedding services. Insurance won’t cover your unhappiness with vendors who don’t meet your expectations for the dress, the flowers, the food, or anything else. If these services were delivered, and you just think their quality fell short, you have to adjust that with the vendor.

- Cold feet. No insurance policy in the universe will cover a bride or groom changing their mind about getting married.

But apart from these, the right wedding insurance can give you peace of mind about all that money you’re spending. And if the unthinkable happens, it can even save the day, and your budget.